The Federal Deficit Was Shrinking...Not Any More

Spring 2018 Update:

The days of the shrinking federal budget deficit appear to be a thing of the past.

After making good progress on annual budget shortfalls following the depths of the 2007-2009 Great Recession, those shortfalls are turning higher. Apparently no longer worried about the deficit once Donald Trump was elected, Congressional Republicans passed the GOP's long-desired tax cuts for the already wealthy, cuts that virtually all economists agree will add roughly another $1.5 to $2 trillion to the federal debt.

We'll be adding more specifics once we pull together some of the recent numbers.

July 2015 Update:

The latest numbers on the federal budget front remain positive. The federal government ran a $51.8 billion surplus in June; economists now are projecting a fiscal year 2015 deficit of only $486 billion dollars, in line with that of 2014. Revenues are up 8.3% over last year while outlays rose only 5.1%.

These numbers are consistent with a growing economy: while larger deficits should be expected during economic downturns, they will diminish as the economy recovers and, eventually, surpluses should be recorded during strong economic times. See our original article and update below for more detail behind the improvement in the deficit numbers since the height of the Great Recession.

Although the economy overall has seen a steady improvement, we still are concerned that the massive wealth accumulated by the top few percent of households over the past few decades has yet to trickle down to the 90+% of America who continues just to tread water. We see this imbalance as a considerable drag to the economy, but we'll save that discussion for another article.

April 2014 Update:

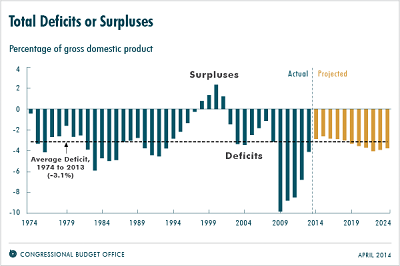

New numbers from the non-partisan Congressional Budget Office (CBO) continue to beat expectations. In an update of their February numbers, the CBO now reports:

- The fiscal 2014 federal budget deficit is projected to be only $492 billion dollars, down from the $680 billion deficit recorded in 2013

- This projected deficit is only 2.8% of US economic activity, which is below the 3.1% average of the past 40 years

- Over the next 10 years, the expected costs of the Affordable Care Act will be $104 billion dollars less than originally projected

The reasons for the continuing decrease in the size of the deficit are explained below in a story we put together based on an AP story from last fall and subsequent email discussions we engaged in. Remember, the federal government's fiscal year runs from October 1st until September 30th of the following year.

(source: cbo) (source: cbo)

Fall 2013: There's good news on the federal deficit front. The 2013 budget deficit came in at ~$680 billion, almost $300 billion less than the ~$975 billion projected early in the year and $420 billion less than the 2012 budget deficit of $1.1 trillion.

There are three primary reasons for this reduction in the 2013 deficit:

- The improving economy (which results in more tax revenue coming in),

- The recent tax increases on the well-off (which also brings in more revenue)

- The 2011 budget deal's automatic spending cuts (which reduces government expenditures)

All economists will tell you that an improving economy is the key to this equation. That's why almost everyone is concerned about the automatic spending cuts, because those cuts will slow the economic growth that we've been experiencing. Let's hope that Speaker Boehner can reign in his Tea Party wing and forge another deal with the White House that addresses the excesses of the automatic cuts and keeps the economy moving in the right direction.

If you'd like to read more on this development and see some other interesting economic statistics, here's an AP story published prior to the end of the 2013 fiscal year, that discusses these trends:

White House Projects Shrinking Deficit

AP - Associated Press

ANDREW TAYLOR and JIM KUHNHENN July 8, 2013

WASHINGTON (AP) - The White House said Monday that the federal budget deficit for the current fiscal year will shrink to $759 billion. That's more than $200 billion less than the administration predicted just three months ago.

The new figures reflect additional revenues generated by the improving economy and take into account automatic, across-the-board spending cuts that the White House had hoped to avert.

The 2013 budget year ending Sept. 30 will be the first one of Obama's presidency in which the deficit won't exceed $1 trillion. Obama inherited a struggling economy and record deficits. A 2011 deficit-cutting deal with Republicans has pared deficits somewhat, as did a tax hike enacted earlier this year on upper-bracket earners.

But Obama has remained at odds with Republicans over cutting benefit programs and further tax increases. The improving deficit picture seems to have taken away some of the momentum for an additional deficit-cutting bargain, but the issue may be rejoined this fall when Obama and Congress need to enact an increase in the nation's borrowing $16.7 trillion borrowing limit to avoid an economy-rattling default on the government's obligations.

Last year's deficit registered about $1.1 trillion. The White House earlier this year predicted the 2013 deficit would be $973 billion.

White House budget director Sylvia Mathews Burwell said that this year's deficit is less than half of the record deficit posted four years ago when measured against the size of the economy. The 2013 deficit would equal 4.7 percent of gross domestic product versus the 10.1 percent of GDP in 2009.

The White House projected that economic growth would be slightly slower in the coming years than it forecast in April. The report said the automatic spending cuts that kicked in in March will slow down economic growth this year from the 2.6 percent increase it forecast for the fourth quarter of this year to a 2.4 percent increase.

But the White House sees a slightly rosier jobs picture. It projects that unemployment will average 7 percent next year and reach 6.8 percent in the final quarter of 2014. That's an improvement over the 7.2 percent unemployment it forecast in April as an average for 2014.

White House budget writers said the decline in the unemployment rate - which has remained at 7.6 percent for two months - has been faster than expected when they completed their initial forecast this year.

"Unemployment is now projected to decline somewhat more rapidly than in the budget projections," the report said.

The government this month said it had received $66.3 billion in dividend payments from the government-affiliated mortgage lenders Fannie Mae and Freddie Mac. The government rescued Fannie and Freddie during the 2008 financial crisis after both incurred massive losses on risky mortgages. The companies received two of the largest bailouts of the crisis.

The recent payments reflect a housing recovery that has made the two lending giants profitable again. So far, Fannie has repaid $95 billion of the roughly $116 billion it received, while Freddie has repaid roughly $37 billion of its $71.3 billion.

|